A person owes 00 on a credit card – Credit card debt has become a prevalent issue, affecting individuals across various demographics. In this comprehensive analysis, we delve into the causes, consequences, and effective strategies for managing credit card debt, using the illustrative example of an individual owing $1000. By examining this case study, we aim to provide valuable insights and guidance for navigating the challenges of credit card debt.

The accumulation of credit card debt can stem from a combination of factors, including financial emergencies, overspending, and poor financial management. Understanding these underlying causes is crucial for developing targeted solutions.

Credit Card Debt Overview

Credit card debt is a common form of consumer debt that allows individuals to borrow money to make purchases. It is a convenient way to access funds, but it can also lead to financial difficulties if not managed responsibly. According to the Federal Reserve, the average American household carries a credit card balance of over $5,000.

Causes of Credit Card Debt

There are numerous reasons why people accumulate credit card debt. Some of the most common include:

- Financial emergencies: Unexpected expenses, such as medical bills or car repairs, can lead to credit card debt.

- Lifestyle choices: Overspending on non-essential items, such as entertainment or travel, can also contribute to credit card debt.

- Poor financial management: Lack of budgeting, financial planning, and impulse purchases can increase the risk of accumulating credit card debt.

Consequences of Credit Card Debt

Carrying high credit card debt can have several negative consequences:

- Impact on credit scores: Credit card debt can negatively impact credit scores, making it more difficult to qualify for loans or credit cards with favorable terms.

- Increased interest charges: Credit card debt typically carries high interest rates, which can add up quickly and increase the overall cost of borrowing.

- Financial stress: High credit card debt can lead to financial stress, anxiety, and even depression.

Strategies for Managing Credit Card Debt

There are several strategies that can be used to manage credit card debt:

- Create a budget: Tracking expenses and creating a budget can help individuals identify areas where they can reduce spending and allocate funds to debt repayment.

- Debt repayment methods: There are different debt repayment methods, such as the debt snowball and debt avalanche, that can help individuals prioritize and pay off debt.

- Negotiate with creditors: In some cases, individuals may be able to negotiate with creditors to lower interest rates or arrange a payment plan.

- Debt consolidation: Debt consolidation involves combining multiple debts into a single loan, which can simplify repayment and potentially lower interest rates.

Credit Card Debt and Personal Finance

Credit card debt can have a significant impact on overall financial health. High credit card debt can reduce savings goals, limit investment opportunities, and hinder retirement planning.

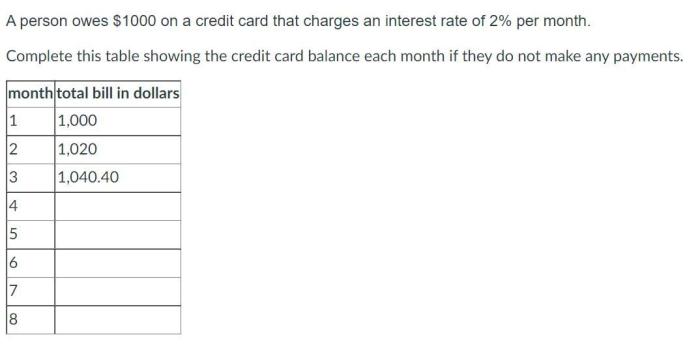

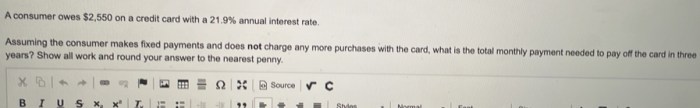

Case Study: A Person Owes $1000 on a Credit Card

| Situation | Causes | Consequences | Strategies |

|---|---|---|---|

| A person owes $1000 on a credit card with a 15% interest rate. | Overspending on non-essential items and lack of budgeting. | Negative impact on credit score, increased interest charges, and financial stress. | Create a budget, prioritize debt repayment, and consider debt consolidation. |

Q&A: A Person Owes 00 On A Credit Card

What are the common causes of credit card debt?

Financial emergencies, overspending, and poor financial management are among the most common causes of credit card debt.

What are the consequences of carrying high credit card debt?

High credit card debt can negatively impact credit scores, increase interest charges, and lead to financial stress.

What strategies can be used to manage credit card debt?

Effective strategies for managing credit card debt include creating a budget, tracking expenses, and implementing debt repayment methods such as the debt snowball or debt avalanche.